Description

Mutual fund industry started with the launch of UTI in 1963, after which Govt. companies and Private players entered in 1987 and 1993 respectively. Asset under management stands beyond 8 lacs crores now however it is still less than 10% households in India, which signifies a huge scope of growth.

The course is structured to help understand the concept of mutual funds and is suggested to be completed in the period of one month. The course begins with basics and demystifies the concepts of Risk, Return, Selection of Schemes, Financial planning, Model portfolios and various other aspects of Mutual funds. As such, this course may also be used for preparing for NISM Series V-A certifications.

This course is specially designed for students or other individuals looking out to build career in mutual fund industry, financial planners and distributors or investors who wishes to understand about mutual funds and financial planning.

Demo

What’s inside :

Course contains video lessons with explanation in easy language for various topics of mutual funds and financial planning. aspects of Capital Markets. It also contains Question bank with 500+ questions and mock tests

Suitable for :

Students aspiring to become financial markets professionals, financial planners, distributors, investors, etc.

Curriculum

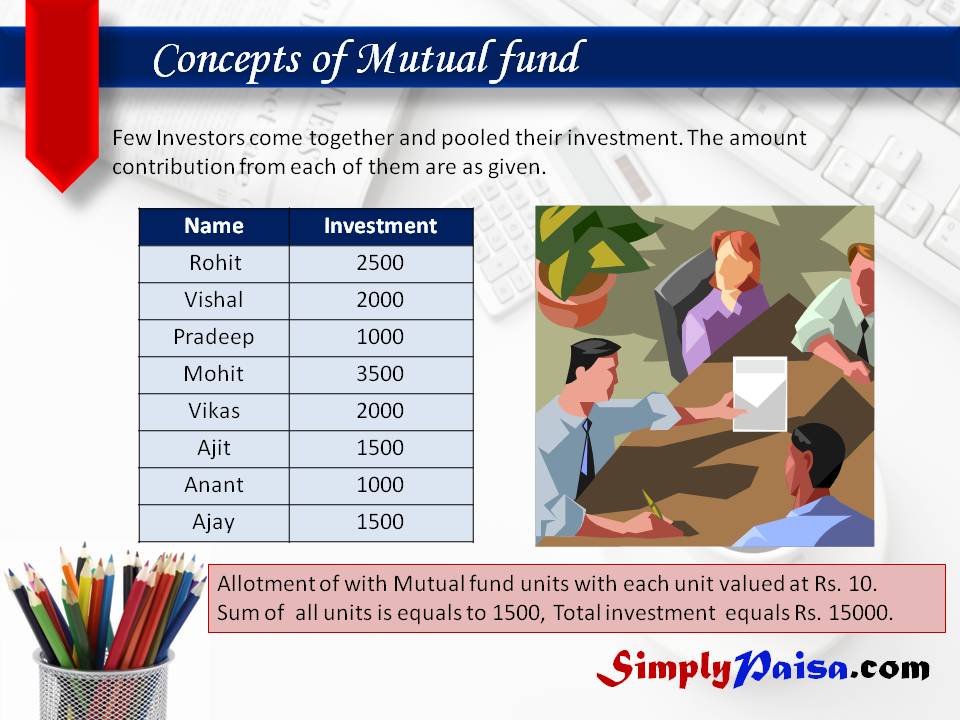

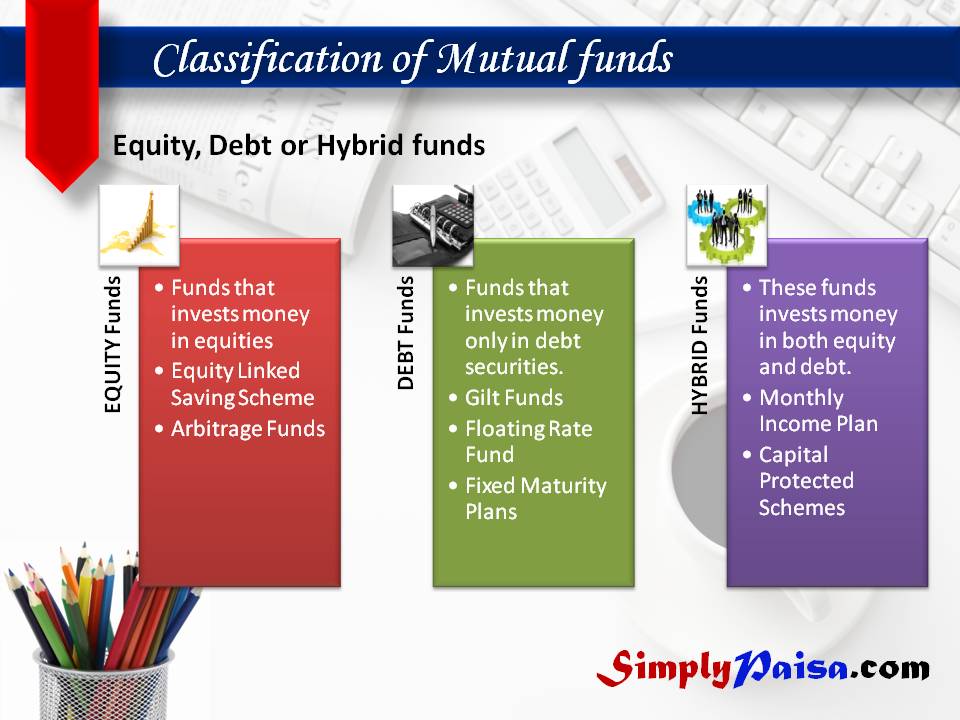

MF Unit 1 : Concept & Role of a Mutual Fund

- Topics covered : Introduction, Types of Funds, Key Developments over the Years

MF Unit 2 : Fund Structure & Constituents

- Topics covered : Legal Structure of Mutual Funds in India, Key Constituents of a Mutual Fund, Other Service Providers

MF Unit 3 : Legal & Regulatory Environment

- Topics covered : Role of Regulators in India, Investment Restrictions for Schemes, Investors’ Rights & Obligations, Can a Mutual Fund Scheme go bust?

MF Unit 4 : Offer Document

- Topics covered : Offer Document – New Fund Offer(NFO), Scheme Information Document (SID), Statement of Additional Information (SAI), Key Information Memorandum (KIM)

MF Unit 5 : Fund Distribution & Channel Management Practices

- Topics covered : Distribution Channels, Channel Management Practices

MF Unit 6 : Accounting, Valuation & Taxation

- Topics covered : Accounting and Expenses, Valuation, Taxation

MF Unit 7 : Investor Services

- Topics covered : Mutual Fund Investors, KYC Requirements for Mutual Fund Investors, PAN Requirements for Micro-SIPs, Additional Documentation Requirements applicable for Institutional Investors, Demat Account, Transactions with Mutual Funds, Transactions through the Stock Exchange, Investment Plans and Services,

MF Unit 8 : Return, Risk & Performance of Funds

- Topics covered : Drivers of Returns in a Scheme, Measures of Returns, Drivers of Risk in a Scheme, Measures of Risk, Benchmarks and Performance, Quantitative Measures of Fund Manager Performance

MF Unit 9 : Selection of Financial Products

- Topics covered : Physical assets v/s Financial assets, Selecting MF scheme, Fixed deposit v/s Debt mutual fund, Evaluting financial products, New pension scheme

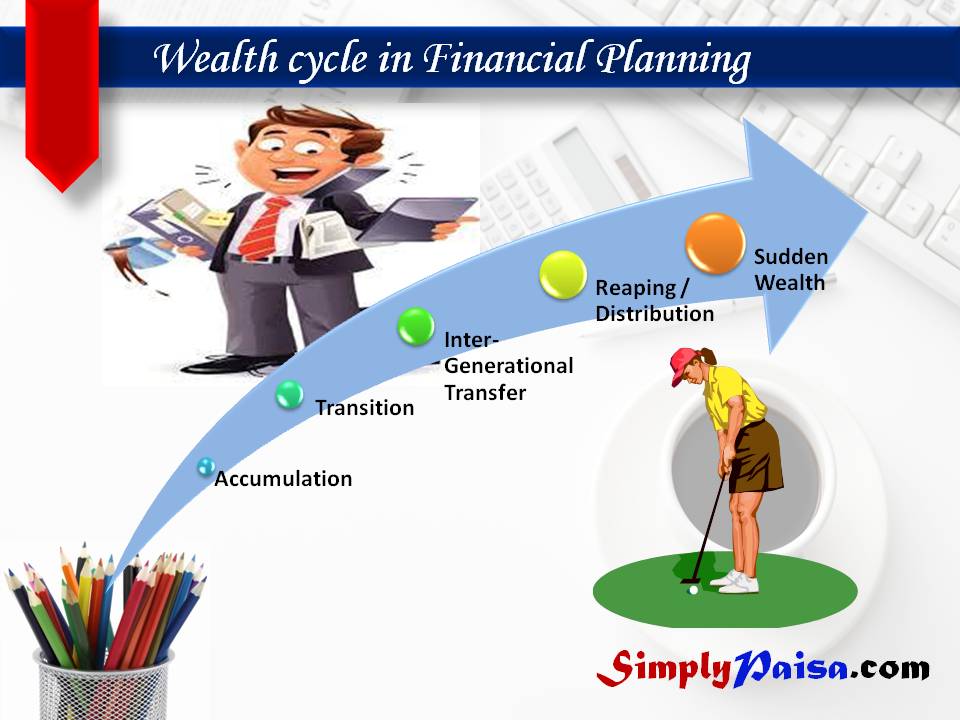

MF Unit 10 : Financial Planning

- Topics covered : Introduction to Financial Planning, Alternate Financial Planning Approaches, Life Cycle and Wealth Cycle in Financial Planning, Risk Profiling, Asset Allocation, Model Portfolios

MF Unit 11 : Question Bank (500+ questions)

Assessment Test